- STUDENTS

- PROGRAM DIRECTORS

SCHOOL ACCOUNT

Log in to review your ranked program details

3D Engineering & Computer game designAccountingAdministación de Empresas y Entornos DigitalesAerospace ManagementAgribusiness / Food Industry ManagementAgro-alimentaire & Agriculture : Droit, Gestion, InnovationAir, Space and Maritime LawAnimation et Création NumériqueArtArt MarketArtificial Intelligence

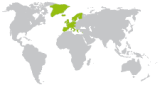

- Africa

- Central Asia

- Eastern Europe

- Eurasia & the Middle East

- Far East Asia

- Latin America

- North America

- Oceania

- Western Europe